The Ministry of Finance in the Democratic Republic of the Congo recently released a statement detailing the success of their petroleum tax expenditure reform. Petroleum-related tax expenditures had reached unsustainable levels, totaling USD 1.6 billion in 2022 and USD 1.1 billion in 2023. To address this, the Government, through the Ministries of National Economy, Finance, and Hydrocarbons, launched a major reform in 2024 to rationalize petroleum tax expenditures with molecular fuel markers provided by Authentix.

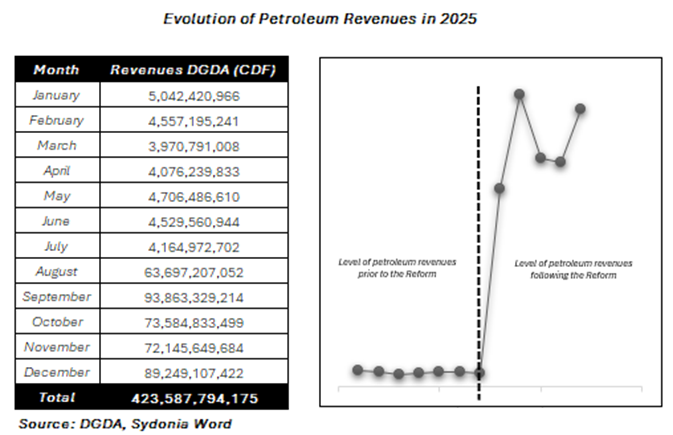

With the reform fully implemented in July 2025 and Authentix-provided fuel marking program in place, petroleum revenues increased by more than 1,700%. Average monthly fuel revenues collected by the General Directorate of Customs and Excise (DGDA) jumped from approximately 4.4 billion CDF before the reform to 78.5 billion CDF afterward. By the end of 2025, DGDA had mobilized 6,848 billion CDF, exceeding the government’s annual revenue target by 9%. The combination of strong policy, coordinated government action, and Authentix’s proven fuel authentication technology transformed fuel from a major fiscal liability into a reliable and transparent source of public revenue. Authentix’s fuel marking solutions worked in parallel with the suspension of import exemptions and deferred payment facilities, creating a closed-loop system of policy, monitoring, and enforcement.

Click here to see the statement.